As 2022 comes to a close at the traditional lightspeed with which things proceed forward in the intangible world of Bitcoin, the author would like to take a moment to ask everyone to think not about the numerous scams, schemes and frauds that beset us all this year. He asks, instead, that you would think about a few anecdotes showcasing the power of this technology to do good in this world.

#Bitcoin is money for everyone, everywhere.

— @DocumentingBitcoin, Dec. 12, 2022

1. Shooting “The Elephant In The Room”

My attempt at “reading the room” upon viewing my Twitter feed on a daily basis undercuts a continually growing sense of dread that permeates the zeitgeist today. Whether politics, personal life, or how the two can interplay in dramatic ways, I can no longer ignore the tension that sits mostly unaddressed as the proverbial elephant in the room.

I reject this dread, this existential discomfort that hums beneath the surface of so much noise, even though I understand why it is present: the constant drama of communal infighting between maximalist sects, the volatile and exciting (if rather depressing) price action, and the attitudes that follow in its wake. Westerners have forgotten their locus of control (or abandoned it, finding it an inconvenience), but I do not believe that the rest of the world has.

We’re shooting that elephant before we get started. It’s important for the context of this piece that you, dear reader, shelve your losses and your frustrations with the markets, briefly dispose of the noisy pump-and-dump “confluencer” crowd, and take a moment to read about some interesting achievements that took place this year, mostly located far from the developed worlds that the techno-savvy so often assume that everyone around them inhabit.

A brief bit of macro-market commentary going into the holidays worth noting, however: a user in the community shared with me these statistics on the least valuable government-printed monies in circulation:

It definitely raises eyebrows when entire nations’ currencies are so debased as to be worth tens to hundreds of thousandsths of a US dollar, a currency so profoundly debased and mismanaged in its own right… THAT Ethereum and Bitcoin continue to command the prices they do without further downward volatility in the wake of Alameda Research’s collapse and the threat that FTX contagion poses to the Grayscale Bitcoin Trust demonstrates that we have crossed the Rubicon into some modicum of legitimacy.

Seeing those valuations of formal, nationally sovereign vehicles of debt settlement are likely to be shocking to the average reader, but to those of us in crypto, these comparisons look like tiny market cap projects ready to spike into popularity (or the final valuations of a since-abandoned token).

I highly doubt that the world will suddenly become inspiredly bullish on the Iranian Rial (a currency for a country wrought with authoritarianism and placed on several U.S. sanctions lists), for example, but the sheer valuelessness of these government-printed assets is inspiring in comparison, given the punching power that Bitcoin and Ethereum continue to wield, even amidst the bear market.

Bitcoin’s life as a credit, equity, and debt-settlement vehicle has only just begun. Much work remains ahead, but it’s time we take the much-ado moment to set aside the malcontents from the rent-free spaces they occupy in our minds, and celebrate some Bitcoin milestones that, while touched on, went unnoticed by many speculators and observers. This is my attempt at correcting that injustice.

Goodbye, SBF. As of this writing, he’s in handcuffs.

Now, let’s talk about what ELSE happened this year..

2. Is Bitcoin Developing Africa, or is Africa Developing Bitcoin?

The TL;DR is, why not both?

Keep reading for some exposition on this idea!

A simple-sounding question like this can often be the most difficult to answer in a few words, but in order to begin to answer, let’s have a look at some unique developments, many of which are being magnified by Bitcoin-centric Twitter accounts like @DocumentingBitcoin. I highly recommend following that account for more and similar content.

In the realm of college and education, the non-profit foundation Built With Bitcoin with the support of Paxful and a number of other non-government organizations constructed a Bitcoin education center in Ejisu, Ghana. The purpose of this center is, as stated: “to equip the local community with skills and knowledge within the finance and technology industries — it’s also intended to build community and foster a safe environment to learn.” The center plans to educate around 400 students in its first year, which sounds small given the vast educational need of the African subcontinent; however, the education is entirely free, and given the expensive nature of a quality education, this seems like a highly promising start.

Ghana has truly taken a central focus towards Bitcoin, as of late. A recent conference housed in Accra saw a number of persons advocating for wider educational efforts to explain Bitcoin’s complexity and technological innovation to the whole continent, if possible! Activist Farida Nabourema is quoted as saying there, “Check the data, do research and ask how this innovation will contribute to your country’s growth. Most elite people who are against it today are those taking advantage of the masses for their own profit!” Indeed, when the money becomes immutably difficult to manipulate, then the people become impossible to victimize through corrupt institutional banking.

Meanwhile, in rural Kenya, the GridlessCompute project continues to harness stranded hydroelectric energy into bitcoin mining. Because the energy was stranded, it was neither being purchased and utilized nor stored and saved; however, thanks to Bitcoin, that energy can now be stored, captured, and utilized by local hydroelectric power plants to cheapen the cost of power in the region. A recent Square and ArkInvest collaborative whitepaper suggests that a much more environmentally sustainable future is, in fact, possible if Bitcoin mining were engaged as an energy capture strategy to strengthen and expand power grids throughout the developing world.

Finally, I have mentioned in previous posts that international remittances are one of the primary costs of international financial transactions that Bitcoin has the capacity to reduce if not eliminate entirely. The proof-positive of this result is the integration of the Lightning network in concert with payment platform Strike, which enabled its “Send Globally feature” last week. Bitcoin Magazine quoted CoinCorner CEO Danny Scott as having said, “By partnering with Bitnob to provide a seamless cross-border experience using Bitcoin and the Lightning Network, we hope to remove some of the friction and cost that customers experience when using traditional FX and money remittance companies.”

What could be more powerful for international commerce than a universally accepted, virtually instantaneous and seamlessly frictionless value transfer mechanism that is immune to counterfeiting and ledger manipulation?

3. Africa Is A Sleeping Bull

In the world of international business, a number of expansion strategies are possible. When the money is a globalized truth as powerful as the Bitcoin block ledger, the world shrinks, and markets suddenly inaccessible to a local business might find the friction preventing that market engagement has significantly shrunken.

In crypto, many of us are acutely aware of institutional corruption. We did not need the failures of Alameda Research and FTX to pull the wool off our eyes. Crypto users in the developing world are forced by circumstance to engage risk-on speculative assets because their government FIAT and bank account privacy are nonfunctional, defective, or in most cases completely nonexistent.

If you’re a reader from the developed world, I’d encourage you to attempt an introspective thought experiment: picture yourself in a home that you know to be your own, one you have known your entire life. However, due to shifting regional borders, ethnic/tribal conflict and/or a corrupt national government, you have no documented proof of your ownership of this home, other than your family’s years-long presence on the property (in the US, we have a concept called “squatter’s rights” that is sometimes exercised under the justification of an inhabiting person taking ownership over abandoned property, but this is a different kind of conundrum). No bank can be trusted to store your money in this situation, and no legal resources are within easy reach that would enable you to prove that your assets are your own. You are, for all intents and purposes, effectively an unbanked person.

What recourse, solutions, or prescription do you have when the local warlord arrives to declare your property forfeit?

The scenario I just described is one that faces thousands of individuals all over the world; by zero means is it localized to the African continent.

In any nation on earth where corruption runs rampant, the population is impoverished, and the money inflated, no one with any sense could blame people for seeking shelter in digital assets. The immutability of the Bitcoin ledger means that no government or nation on earth possesses the means to overthrow the ledger. Bitcoin’s ledger can’t be bribed, misappropriated, mislent or misspent by some faraway party. The trustless nature of Bitcoin isn’t merely a feature of its hard-coded nature or its pseudoanonymous design; it is also an inalterable vehicle of value transference and record-keeping for those that have been (incompetently or maliciously) gatekept from access to credit and leverage for their assets.

As a student of anthropology and business, I cannot but admire the persistence of the African Bitcoin community. If you feel like you face resistance when you talk about Bitcoin or Ethereum with your no-coin relatives, imagine being an African Bitcoiner advocating that a corrupt government recognize your immutable assets as legitimate value transference. A currency they cannot control, issued by private individuals at a fixed and decreasing rate who cannot be threatened or coerced to change anything? Such an asset is a danger and a threat to authoritarians everywhere, to say nothing of their power to retool or manipulate a central bank digital asset they themselves might create.

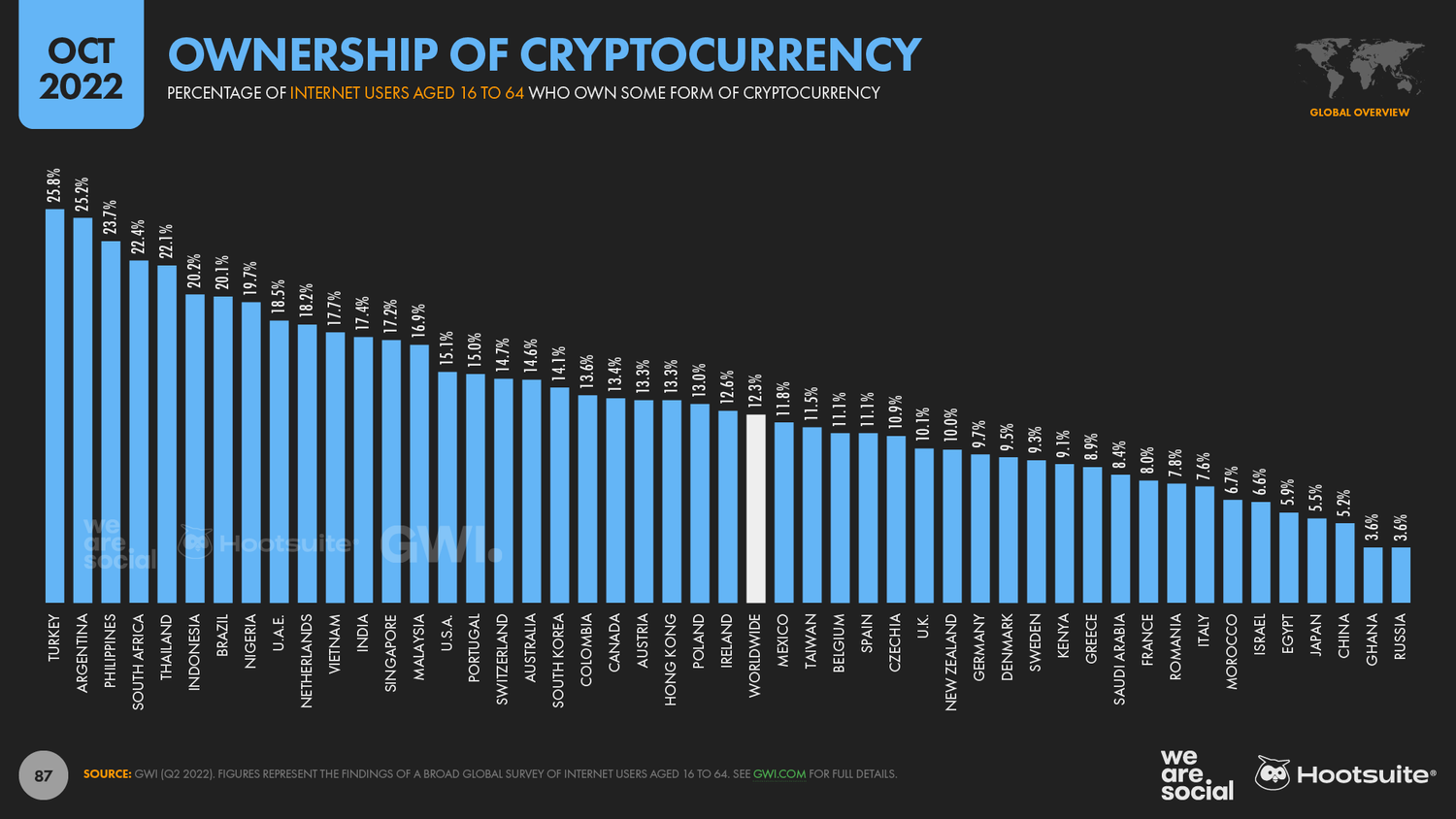

Furthermore, the integration of Bitcoin into the African consciousness will deepen and enrich the connection between this oft-misunderstood continent and its many diverse cultures and groups, bridging them easier with the rest of the world that seeks to engage Africa’s people in international commerce. They have always deserved an opportunity to be networked into the more connected world we’ve come to know so well (and sometimes resent!), and its people have a vast number of motivating factors that would cause them to want to adopt Bitcoin along their journey. Some general statistics about who Bitcoin is being adopted by, worldwide, provide the final part of the tale:

I should note: this data is, itself, out of date as I write now, in December. I suspect these numbers have shifted since this study was conducted, but nevertheless the number of people in the world choosing to trust the trustless internet money continues to rise, most noteworthily in nations with inflated currencies and famously corrupt institutions at various points in recent memory (excepting the Netherlands… what are YOU all doing all the way up there!?)

Although it would be easy to paint a portrait of the rise of CBDCs like the digital Yuan, and governments’ desires to control their citizenry’s spending habits, could it not be equally possible that this rising interest in crypto around the world has less to do with crime, nothing to do with governments’ desires, and everything to do with the people of these countries responding to their own economic conditions? It shouldn’t need to be said once again, but I shall repeat it endlessly regardless: immutable blockchains like Bitcoin and Ethereum are NOT the vehicle for crime and money laundering that the central bankers present.

I have met countless users from many of these countries and though we come from different cultures, different languages, and different worldviews that otherwise might bring us to conflict, we are united in the belief that we should all have an equal opportunity to earn something, and that being part of a global market economy should be easier than ever before.

The more of these conversations that I have, the more convinced I am that facilitating the unbanked commercial activity of people on the internet is a worthy cause. Badass services like tip.cc demonstrate how it’s all possible, with the bot and community around it standing on Discord as a testament to how one platform or business can become a launchpad for numerous other platforms or businesses, and so on, and so forth… the cycle ever continues, all powered by Bitcoin, Ethereum, Binance, and many other blockchains besides.

This has inevitably gotten me to ponder the question… is Africa a sleeping bull?

Could a widely adopted and engineered-to-be-scarce asset (even if speculatively volatile in market value) pave a more equitable road forward for a continent trying to forge ahead with optimism despite centuries of exploitation by foreign powers of the west and east, IF the ledger promises to be unalterable by malicious means? I’d be lying if I said I was sure the answer was a resounding continent-wide adoption, but I’d also be lying if I said that there exists no pathway for Africa to develop through Bitcoin.

The financial battle for the soundest money of the human species has now begun, in earnest!

Concluding Thoughts

Around the world, some people do not even have the privilege of being able to conduct simple Know-Your-Customer requests because they have no fixed address to report, often by no choice of their own. Such individuals still deserve the right to own and control assets, tied to them; assets not even a government could deny them.

As we further flush out each malicious malcontent with every passing cycle, take solace in how far we’ve come, and steel yourselves, for there is much farther to go, still. After all, no one said that being on the technological frontier was going to be easy.

Thank you so much for reading, and I hope this new year brings you the warmest of tidings from wherever in the world that my words find you. This has been a transformative year, to put it mildly, but better times are in store for those who have the will to work and achieve them. Stay at it and stay curious, my friends!