For this tutorial, we will walk through setting up a Ledger with MetaMask to add liquidity on PancakeSwap. If that sentence looks like word salad to you, this video from Finematics will provide a great introduction to liquidity pools. What follows here is a brief overview of the features offered by PancakeSwap. By the end of this guide, you should be able to navigate through a wide variety of dexes, including BSC projects like 1Inch, and Ethereum-based exchanges such as UniSwap. If you’re already familiar with other dexes, feel free to skim, or skip ahead to Setting Up MetaMask with Ledger.

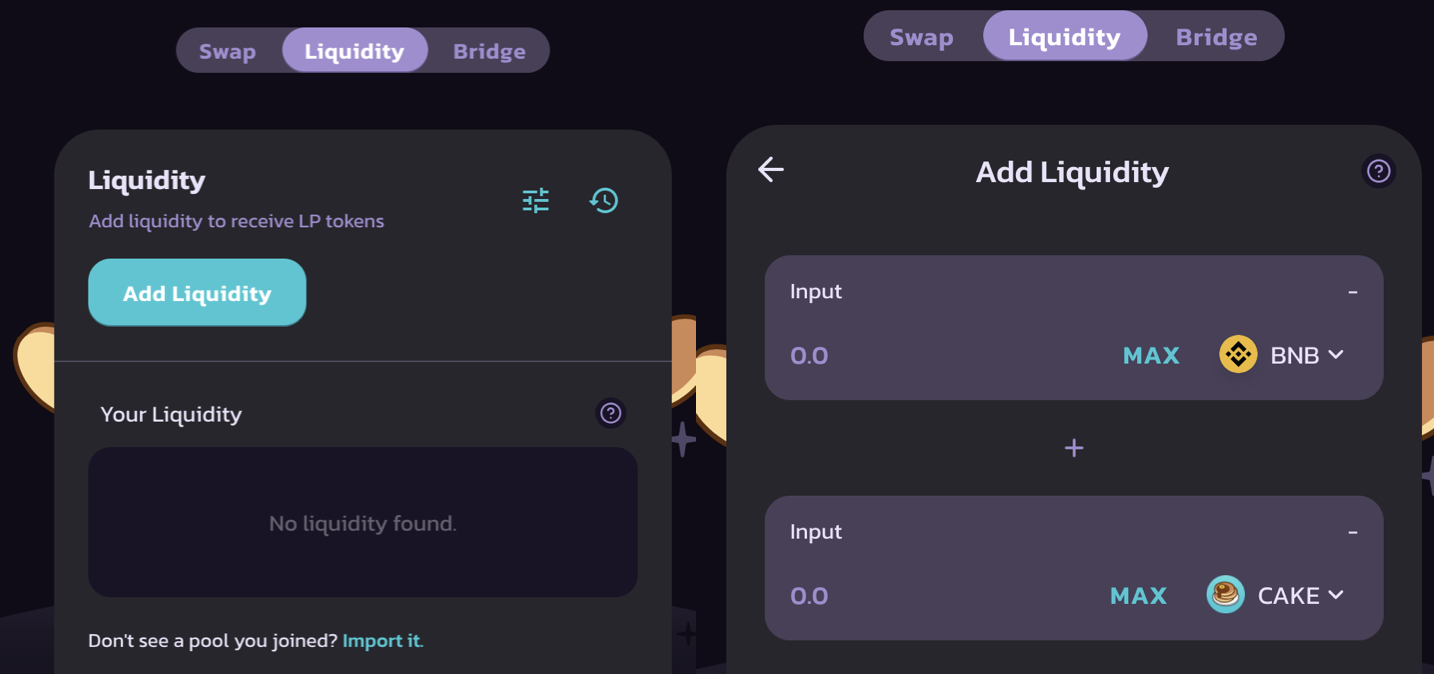

Liquidity

Dexes like PancakeSwap are automated market makers. In contrast to exchanges like Coinbase or Kraken, which rely on order books to pair traders, AMMs use liquidity pools. Basically, they incentivise users to provide liquidity for trading pairs – i.e., an equal ratio of CAKE and BNB – by giving providers a portion of the trading fee each time someone trades that pair. The dex will take your currencies and give you Liquidity Provider tokens in exchange, which in the case of CAKE-BNB liquidity, appears as CAKE-LP in MetaMask. You can redeem these LP tokens at any time for the coins you initially put into the pool, plus the accumulated rewards from trading fees, which may come out to different values due to price changes over time. Keep in mind that with more volatile pairs, you may incur Impermanent Loss, which is essentially a temporary paper loss due to drastic changes in price between the two tokens you’ve chosen. This can happen regardless of whether the relative price moves up or down, so for a safer investment, it’s wise to select tokens which correlate tightly, or a pair including a stablecoin like BUSD.

Farms

Farms allow you to stake your LP tokens to gain further rewards from your liquidity. For the above example, we’ll be looking at the CAKE-BNB farm, which will pay out CAKE rewards that will accumulate over time.

Syrup Pools

You can reinvest your CAKE from Farms into Syrup Pools, which allow you stake CAKE in return for even more CAKE, or other tokens like HAKKA or TLM.

Most of these Pools are “manual,” meaning you have to click in order to claim your reward, but the Auto pool for CAKE will harvest your rewards and deposit them back into the pool, allowing you to take advantage of compound interest without incurring transaction fees. Restaking is facilitated by the “bounty,” which appears at the top left of the Syrup Pools page. Essentially, it pays out a certain amount of CAKE to whoever clicks on it in order to restake the tokens for everyone else who has deposited into the pool.

Lottery, Prediction, & Other Gimmicks

Lottery and Prediction, while novel, seem to be ways for liquidity miners to gamble. Lottery is a longstanding feature of PancakeSwap, but Prediction is a relatively new addition and has been prone to bugs. PancakeSwap also offers NFTs, which at the time of writing sell for around 1 CAKE (~$30). We’ll stick to the more standard features offered by PancakeSwap and other dexes so that you can become familiar with a wide range of decentralized apps on both Ethereum and Binance Smart Chain.

Setting Up MetaMask with Ledger

This guide continues from our previous article, Setting Up a New Ledger with MetaMask, and utilizes that setup to get started with PancakeSwap. Importing a Ledger to MetaMask is slightly less convenient than using MetaMask on its own, as you will need to have the Ledger plugged into your computer each time you want to sign a transaction. However, this drawback is well worth the added security of keeping your private keys offline, especially since MetaMask is a browser extension, which makes it notoriously vulnerable. After connecting your hardware wallet, you will not be able to move your tokens without having the Ledger plugged in – but neither will thieves.

After you’ve imported your Ledger to MetaMask, plug it into your computer and open the Ethereum app on the Ledger. It’s confusing, but this works for both Ethereum and Binance Smart Chain-based dexes. On PancakeSwap, click the Connect button on the top right corner of the screen, select your Ledger wallet in MetaMask, and then approve the connection on your Ledger.

For the following steps, you will initially approve a transaction in MetaMask, but the transaction will not submit until you approve it again on your Ledger. Be sure to specify the amount you wish to swap, deposit or withdraw before confirming, because it’s easy to end up paying gas fees for a null transaction.

Depositing Liquidity

The first order of business will be providing liquidity. To keep things simple, we’ll start with the CAKE-BNB trading pair. For this step, you’ll need an equal dollar amount of both CAKE and BNB. You can buy both on a variety of exchanges, but if you already hold BNB, the easiest way to get CAKE would be to trade for it within PancakeSwap.

Navigate over to Trade, and then Liquidity on the left side of the screen. Be sure to select Liquidity and not V1 Liquidity (old) – this is the recently outdated protocol that will likely disappear soon, and regardless, if you deposit there you may not earn rewards.

Next, click the Add Liquidity button in the center of the page, and select BNB and CAKE as your two tokens.

Now, simply deposit an equal amount of both BNB and CAKE. To keep things low-risk, you can start with $10 of each coin, but feel free to deposit as much as you’d like. Then approve the transaction on your Ledger. You will then see CAKE-LP tokens in MetaMask.

Farm Liquidity

If you’d like to earn continuous rewards on your liquidity, navigate over to Farms on the left side of the screen. Since CAKE-BNB is the trading pair we’ve just provided liquidity for, we’ll deposit our LP tokens in the corresponding Farm. If you cannot see your LP tokens in MetaMask, simply click View Contract and copy the contract address at the top left of the page. Then, scroll down to the bottom of your Assets in MetaMask, click Add Token, and copy that address in the Token Contract Address field. MetaMask will autofill the rest, and you from there you will be able to see your tokens and deposit them.

Deposit to Syrup Pools

Once you’ve harvested CAKE from Farms, or if you simply have more leftover, you can invest those once again in Syrup Pools. The simplest option is called Auto CAKE, which automatically harvests any CAKE rewards accrued and reinvests them in the pool, allowing for compound interest as described above.

Now that you understand Liquidity, Farms, and Pools, you will be able to navigate other dexes with ease.