Preface: In no way is this article intended to constitute financial or investment advice. This piece solely represents the opinions of the author, and does not necessarily represent the opinions of tip.cc, its developers, or its community. As Calvin would say, “caveat emptor.”

PonziPrep - “Lending, Borrowing, and Paying The First Guy Back”

What, exactly, is a “ponzi scheme?”

Somewhat akin to an advanced form of wire fraud, a true blue Charles Ponzi-style con game takes the economic shape of new investors becoming utterly necessary to repay the liabilities of its earlier investors, and it's easy enough to confuse a platform developer borrowing money to facilitate its development and growth with a platform developer borrowing money to pay out early investor liabilities. These are not the same thing, and it’s a simple mistake to see them as the same, the difference being somewhat technical.

In crypto spaces, we frequently see this term levied against anyone we feel had to borrow money in order to settle other debts (see AltCoinBuzz’s reporting on how the Celsius Network ($CEL) borrows money to pay out its customer liabilities, a disconcerting reality for any investor).

Nexo.io, a similar competitor to $CEL and a personal favorite of mine, does not itself borrow funds backed by users’ deposited assets, but rather facilitates those same users’ borrowing at a loan-to-value ratio of 50% or greater, taking a profit out of the interest on these loans. Like $CEL, $NEXO has tiered loyalty levels, but its strategy of overcollateralization ensures that loan defaults and dropping prices do not threaten the viability of the platform, provided that their oracle liquidates its users’ assets at the correct margin threshold to cover their debt relative to the sinking value of a user’s collateral. The platform’s rates are supported by the costs of borrowing money, which compound at the same daily speed as the earnings.

Neither Celsius, nor Nexo or similar competitor BlockFi offers interest rates that could be considered the stuff of fantasy (higher APY promotions are a common feature of these platforms, but rarely are such rates a fixture. They are frequently lowered to more sustainable rates after a period of weeks).

Nexo offers 10% stablecoin interest with “any time” withdrawal features and additional percentages for locked-in time periods, presuming you have the right loyalty level, and a slight earnings boost if paid in $NEXO tokens. Celsius operates at similar rates and payment schemes, with up to 18% interest payable in $CEL tokens for those who so chose to go that route. With all the questions of these centralized lending platforms’ viability, again, they never offered rewards rates quite at the disconcerting level of “several free lunches a day.” Assuming they’re operating by simply cutting out 60+% of a centralized bank’s expenses in retail space, wages, rental and other fees, these rates are not outside the realm of believability.

Enter the $OHM fork.

PonziNomics - “I’m playing investment chicken with an oncoming train!”

Please, do not misunderstand me. High-APY decentralized autonomous organizations are, in and of themselves, not necessarily Ponzi schemes, and this is not an indictment of any one coin or community. However, in order to explain the problematic nature of the seven-figure interest rate, some examples will be given. This is not a personal attack on anyone; I myself have bought into two high-APY projects, but the sheer risk factor of these is so great, I could not afford to risk any more than $50 total on them. Many risked far more than that.

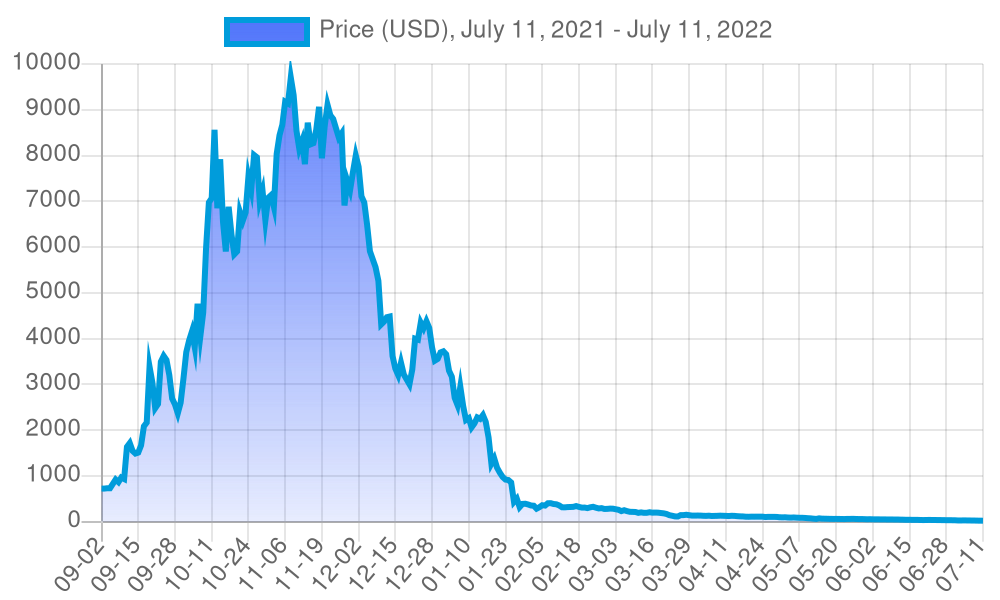

The first, and most prolifically cloned of the high-APY DAOs would be OlympusDAO. With 120,000+ holders and a treasury balance of $328 million as of this writing, it’s difficult for me to call OlympusDAO a failure as ThisMorningOnChain did when talking about the incredible downward price action of a popular $OHM fork. However, their chart of popular $OHM fork’s does make an incredible point, with prices accurate as of early 2022. In this current market environment, many of these are much lower now:

Notice the utterly outrageous APYs. If these were graphed on a curve, $OHM’s 8000% would seem downright manageable, and few of these were as popular as Wonderland and Jade Protocol. And, not a single project among these presents a rebase or rate of return anywhere NEAR sustainable.

Which, naturally, raises the question: where do the 6-9 figure returns actually come from? If you believe mathematics leads to the truth, then the answer is clear. It comes from one of two sources:

- the outrageous inflation rate of the token,

- or from investors down the pyramidion from you.

The Ponzi King himself, Bernard Madoff, would likely salivate from the grave if he thought he could get returns of 3-4 figures, to say nothing of 6-10. He’d be so rich, he could have purchased the prison they held him in for cash.

JADE Protocol, one of the more viral of these $OHM rebase projects, signaled its intentions in a Medium article published late last year:

For the first time ever, a fork of OlympusDao will be incorporating cash incentives to push the entire community to “3,3.” If you’re not familiar with “3,3” — it simply means: buy $JADE, then stake it, and then don’t sell $JADE.

Simple? Good.

Here at Jade, we’ve added an additional “3” to signify the 3 steps:

Step #1: Buy $JADE here.

Step #2: Stake $JADE here.

Step #3: Don’t sell $JADE.

Abide by these simple rules, and you’ll be given a distribution of a weekly prize ranging from $1m BUSD to $10m BUSD.

3,3,3 and you’re gucci.

If the project isn’t utilizing an actual government money printer, they’re inflating their token supply and pretending it’s the same value. Basic economics, and memes, show us where this train leads, and it is not to riches.

PonziChicken - “I Want To Play A Game … Using YOUR Money”

Picture this… it’s the Wild West, and you’re a gold speculator, meaning that you travel throughout the vast frontiers looking for untapped veins of gold. The railroad companies have ensured there’s plenty of track to go from place to place, but there exists only one railroad line, and you, the trader, are pumping (yes, pumping) along the track.

Buying into a (3,3) prisoner’s dilemma project is the investment equivalent of you, and your hyped-up degenerate comrades, as in this old-timey photo, pumping your handcar along that metaphorical railroad track. YES, you CAN work together and achieve speeds faster than the fastest horses. However, there exists only one track, and the train is oncoming: it’s coming right for you.

Here’s the game theory chart as to why, often referred to as “The Bonnie and Clyde” problem, or the “Competing Firms” problem. The description as cited by the board game aggregator nerdsonearth.com describes the Prisoner’s Dilemma thusly:

“Let’s say two criminals are in holding cells for participating in the same crime. Police are trying to get testimony from each to get them to turn on their partner. Each partner has two options: they can remain silent or they can spill the beans. This creates a matrix of four outcomes, depending on what each prisoner does. Essentially, the best collective outcome is if both prisoners remain silent. However, the best individual outcome is for one of the prisoners to turn. The paradox is that if both prisoner’s turn on the other, they result in the worst individual outcomes for both of them” (Nerdsonearth.com).

You are pumping your handcar directly into its path, as its steam horn blasts the obvious foreshadow of what is to come. As to what happens next, it’s not a pretty picture, no matter how it’s viewed:

Simply put: in the land of the rapid-fire rebase projects, the first-buyer whale is king. Worse than ‘the blind leading the blind,’ the first whale needs only to lead the pump-wagon handcars into the oncoming train, as they ride off into the sunset with their pilfered sack of riches:

Thank you all for reading, and as always, stay curious, dear readers…